We never rotate or lend your money, or lease your gold.

Security & Fraud Protection

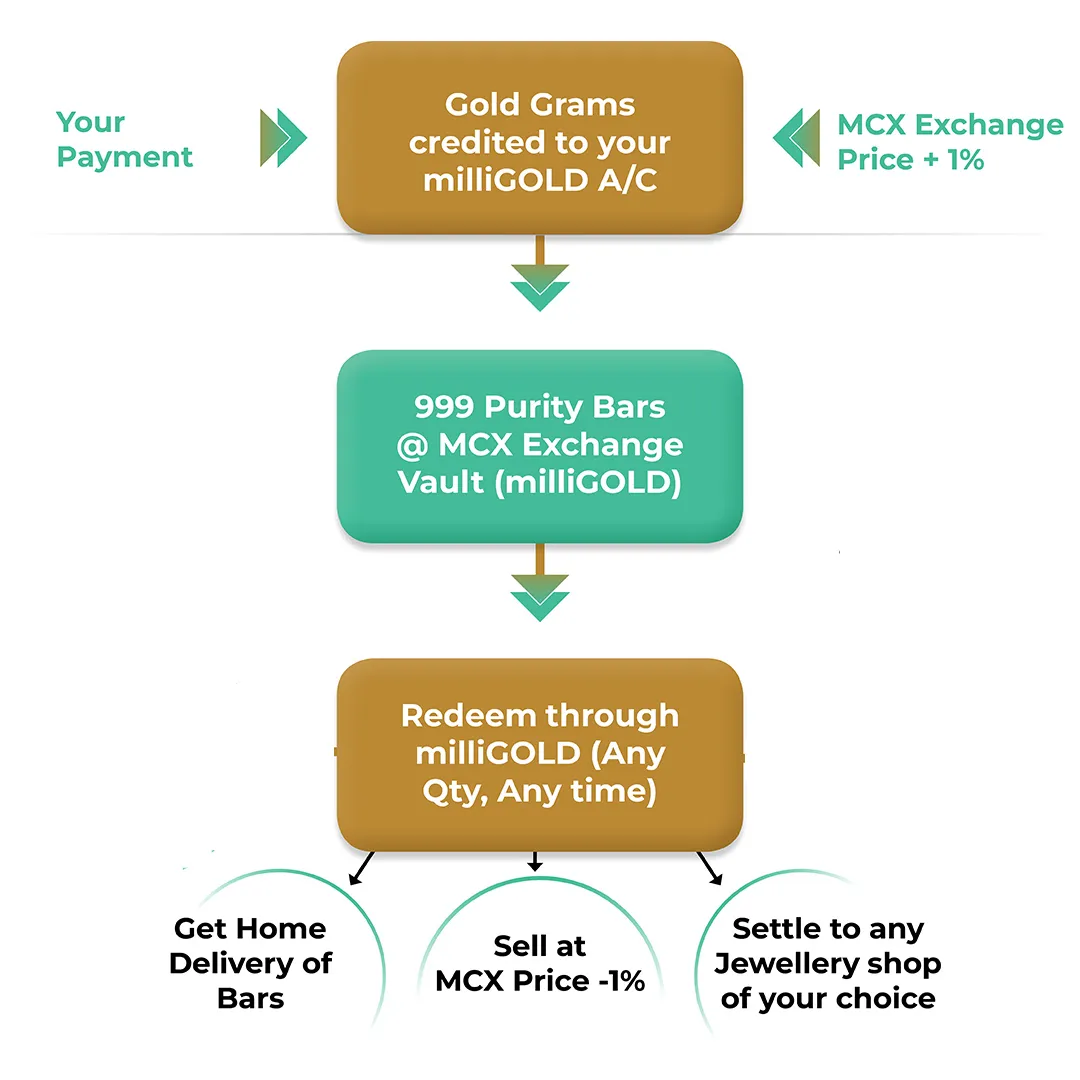

We buy & store 999 purity Gold bars at the MCX Exchange. You legally own this gold, even though it is in our safe custody. It stays there idle, till the day you need it for buying jewellery. When you are ready, we sell & settle the value of your accumulated grams at that days market price—allowing you to buy the same weight of jewellery regardless of how much gold prices have risen. You can digitally settle to any shop in India.

milliGOLD has secured fidelity guarantee insurance against fraud and cheating by its own founders, directors and employees, reinforcing our commitment to transparency and customer protection. Storage risk is already covered by MCX Exchange.

Payment partners

The 11 month schemes offered by Jewellery Shops is just not adequate for us. How much can you save in 11 months? It is not secure. And we are stuck with one shop

By the time we saved enough money to buy a particular Jewellery item, the price of the item has increased much more. Gold prices have increased by 150% in the last 3 years alone

We can keep buying gold coins from Jewellery shops and melt them later for Jewellery. It is so expensive and inconvenient

Our children & grand children should have the freedom to buy the designs that they like, using the Gold that we saved

Flexible and Convenient

Join our Subscription Plans (Rs 500 per day to Rs 40,000 PM), or save any amount any time using UPI Payment. Pause, Cancel or Upgrade Plans. Skip payments without penalty. Make bulk purchases through bank-transfer. Withdraw your gold grams fully or partially any time. Buy Jewellery in any shop of your choice.

2019

milliGOLD was incorporated and launched

₹ 8,000/month

Average saving per milliGOLD subscriber

0

Number of customer grievances received by milliGOLD till date

₹ 1,225,642 crores

Market size of Gold trading at MCX exchange in 2023

Some of our Customers

Vidya Santhosh

₹ 2,000/month

September 2024

Krishnan C

Bulk Investments

January 2025

Vijay Ayappan

₹ 40,000/month

November 2024

Vilaas BV

₹ 10,000/month

August 2023

Thandri Narayanan

₹ 4,000/month

July 2023

Sumathi Shankaran

₹ 5,000/month

August 2020

Sripriya Rao

₹ 1,000/month

January 2022

Sneha Sathish

₹ 1,000/month

Novemeber 2022

Siva Subramanian

₹ 6,000/month

January 2023

Sankarnarayanan

Bulk Investments

January 2023

Sankar Ganesh

₹ 1,500/month

June 2024

Sampath Raghavan

₹ 1,000/month

February 2021

Krishnaprasad R

₹ 2,000/month

September 2020

Jayashankari

₹ 8,000/month

April 2022

Harikrishnan K

₹ 40,000/month

November 2021

Deepika G

₹ 1,000/month

September 2022

Ashwin Kumar

₹ 1,000/month

January 2021

Simple, Transparent Pricing

Buy at MCX Price + 1%. Redeem at MCX Price -1%

Want to know more about us?

Got more Questions?

Register for a call back from our customer support officer